Standard VAT rate schemes

VAT on sales: where Domestic Reverse Charge (DRC) is applied, the suppliers must not enter any output tax, but only the net value of the sale.

VAT on purchases: services bought which are subjected to DRC, the VAT amount must be entered as an output tax. The Customer may reclaim the input tax on the reverse charge purchases, subjected to the normal VAT rules.

Impact on Flat Rate Schemes

Flat Rate Scheme users who receive reverse charge supplies will have to account for the VAT due to the HMRC and recover it simultaneously on the same VAT return.

Users of the Flat Rate Scheme will have to consider if it’s still beneficial to them, bearing in mind that under this scheme they cannot recover VAT incurred on purchases of materials, overheads and so on.

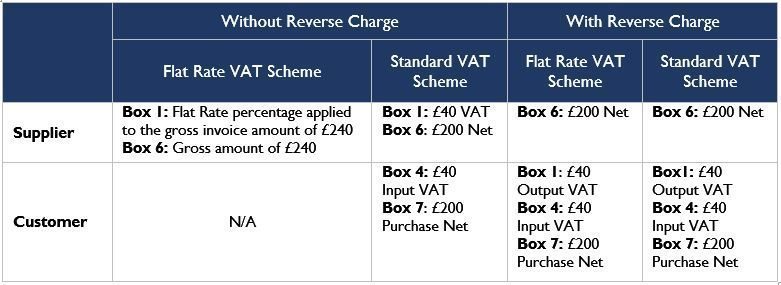

See the below illustration table on how the DRC will affect the VAT Return of Standard and Flat Rate VAT schemes for an invoice of £200.

Invoicing

Invoices with DRC must include the reference ‘reverse charge’ and should mention that the customer is to account for the VAT, along with the normal information required on a VAT invoice.

HMRC suggests the below examples:

- Reverse charge: VAT Act 1994 Section 55A applies

- Reverse charge: S55A VATA 94 applies

- Reverse charge: Customer to pay the VAT to HMRC